Guide to Verify your Income Tax Returns.

Once you have Filed your Income Tax Returns you will get the Acknowledgment number and the next step is to E verify your Income Tax Returns. Income Tax Returns Filed has to be E Verified within 120 Days from the Submission of Returns. Incase this step is not Completed your Income Tax Returns is not processed.

Once the E Verification is Completed the Refunds are processed.

There are two ways to verify your Income Tax Returns.

- Verify ITR V by Sending in Post

- Verify ITR V by Net Banking

We recommend to complete Verification Using your Net Banking.

Steps to Verify your Income tax Returns using Net Banking

1) Log into your Net Banking and Find the Link Which takes you to the Income Tax Portal. If you are filing your Income Tax Return First time you have to register yourself in the Income Tax portal.

Steps to Login to Income Tax Portal Using Different Net Banking Websites are given below.

1) E Verify your Income tax Returns using HDFC Net Banking

2) E Verify your Income tax Returns using SBI Net Banking

3) E Verify your Income tax Returns using ICICI Net Banking

4) E Verify your Income tax Returns using Kotak Net Banking

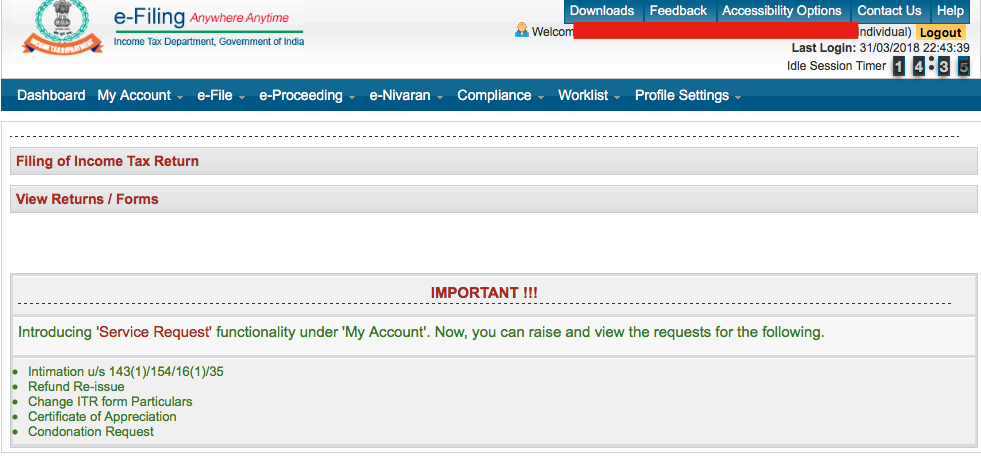

2) Once you are in the Income Tax Portal Select View Returns / Forms.

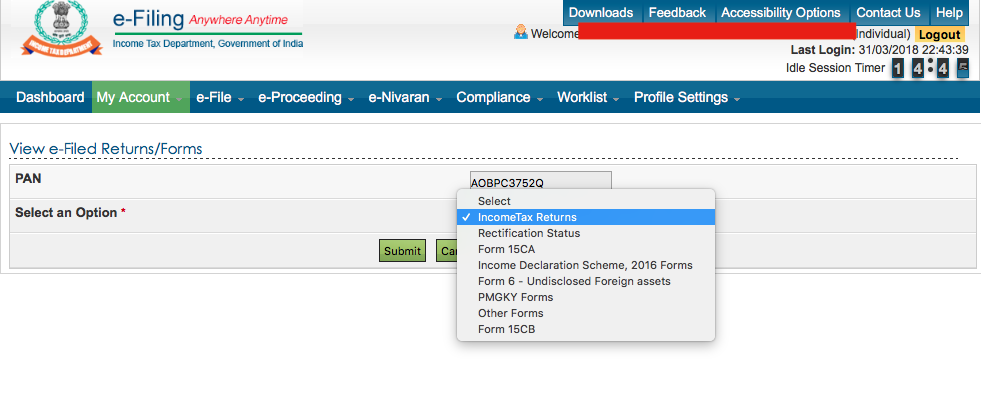

3) Next Select the Option as Income Tax Returns and Submit. You will See all your Income Tax Returns Filed.

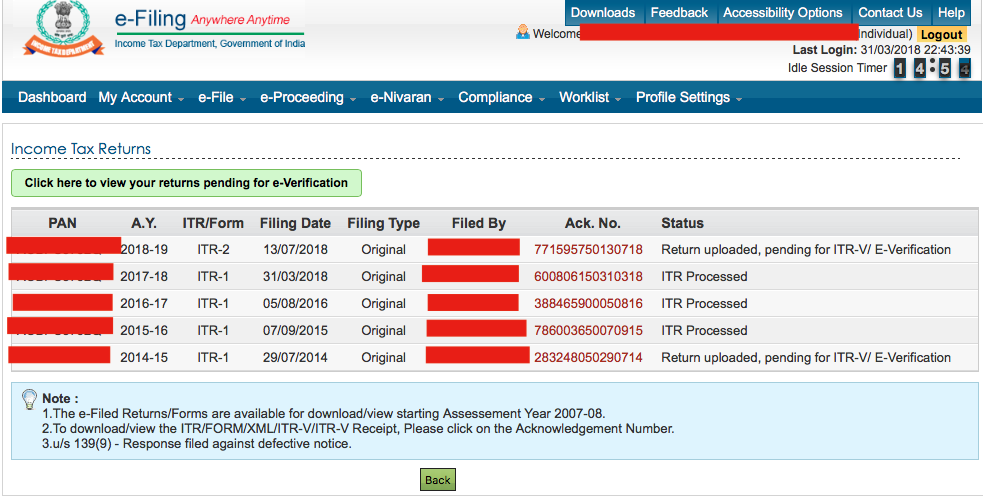

4) Select “Click here to View your returns pending for e-verification”

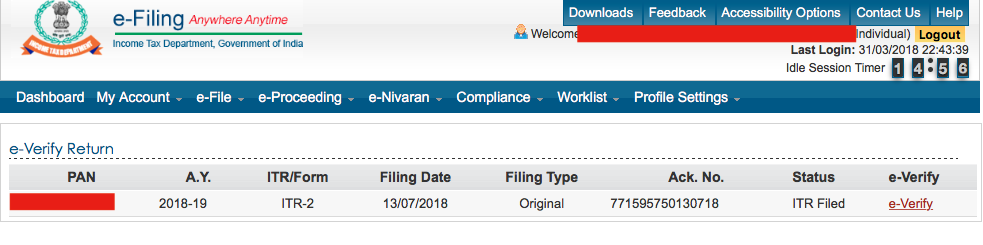

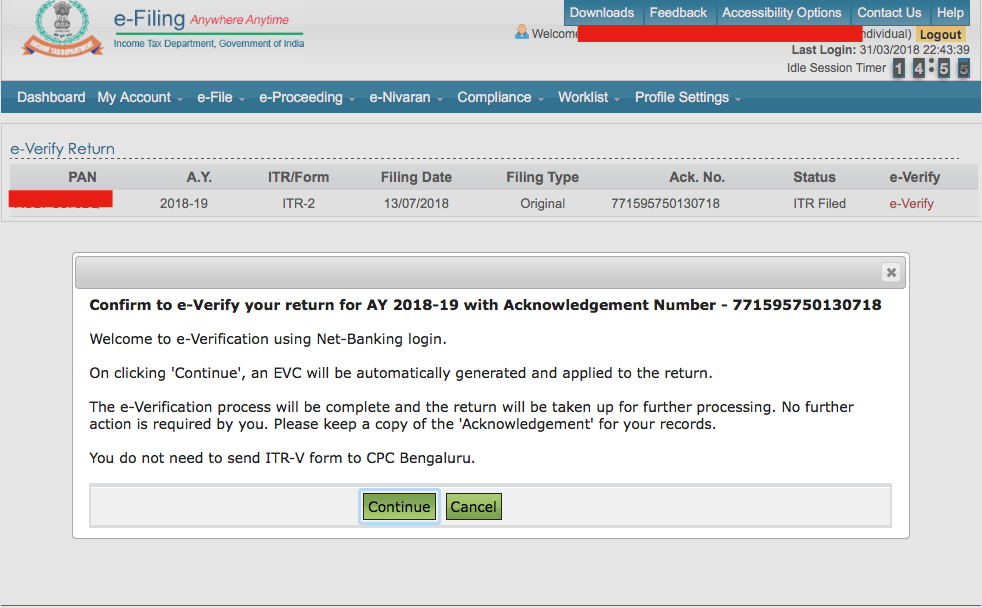

5) Select the option “e-verify”

6) Select the option as “Confirm”

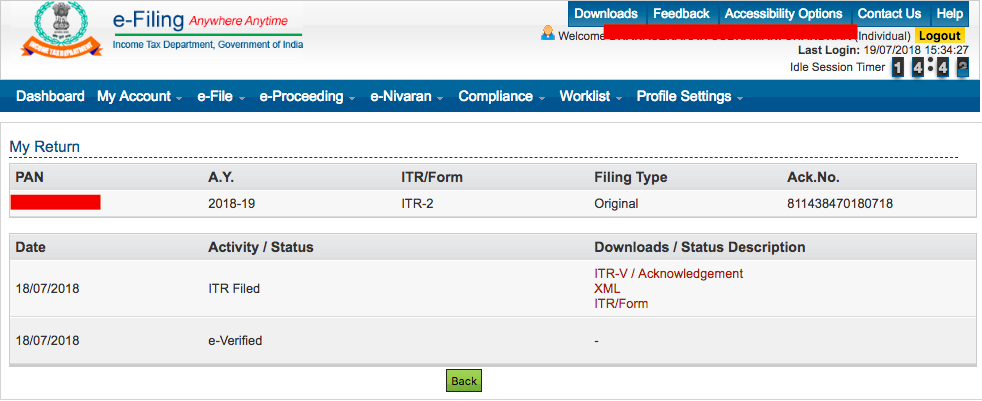

7) Your Income Tax Returns is Successfully Completed once the E Verification is done. You can download your ITR Acknowledgment and the ITR Form Submitted for your reference.

Incase you need any clarification related to E Verifying your Income Tax Returns you can contact our support team.

YOU MAY ALSO LIKE

Everything That You Need to Know About Income from House Property Your home, your office, or even a shop can be your house property. According to the Income Tax Act, there is no differentiation between a commercial and a residential property. Every property is taxed under the single head of ‘income from house property.’ Here is all you need to…Read More

Income Tax Slabs are differentiated based on the Tax Status, Gender and Age of Individual Tax Payer Income Tax Slab Rates for an Individual Upto the Age of 59 Years for both Male and Female or an HUF (Hindu Undivided Family) in Financial Year (2019-2020) Assessment Year (2020-2021). Taxable Income Range Tax Rate in % 0- 2,50,000 NIL 2,50,001 –…Read More

Which is Better ELSS or PPF? Savings form an important part of our life. It is important that you not only save but also invest the savings into the right products. It is essential to have knowledge of different products when making an investment decision. Equity Linked Savings Scheme (ELSS) and Public Provident Fund (PPF) are two products, which are…Read More