Pay Your Income Tax Online – Challan 280.

The Challan 280 is Used to Generally used to Pay Income Tax for Companies and Individuals.

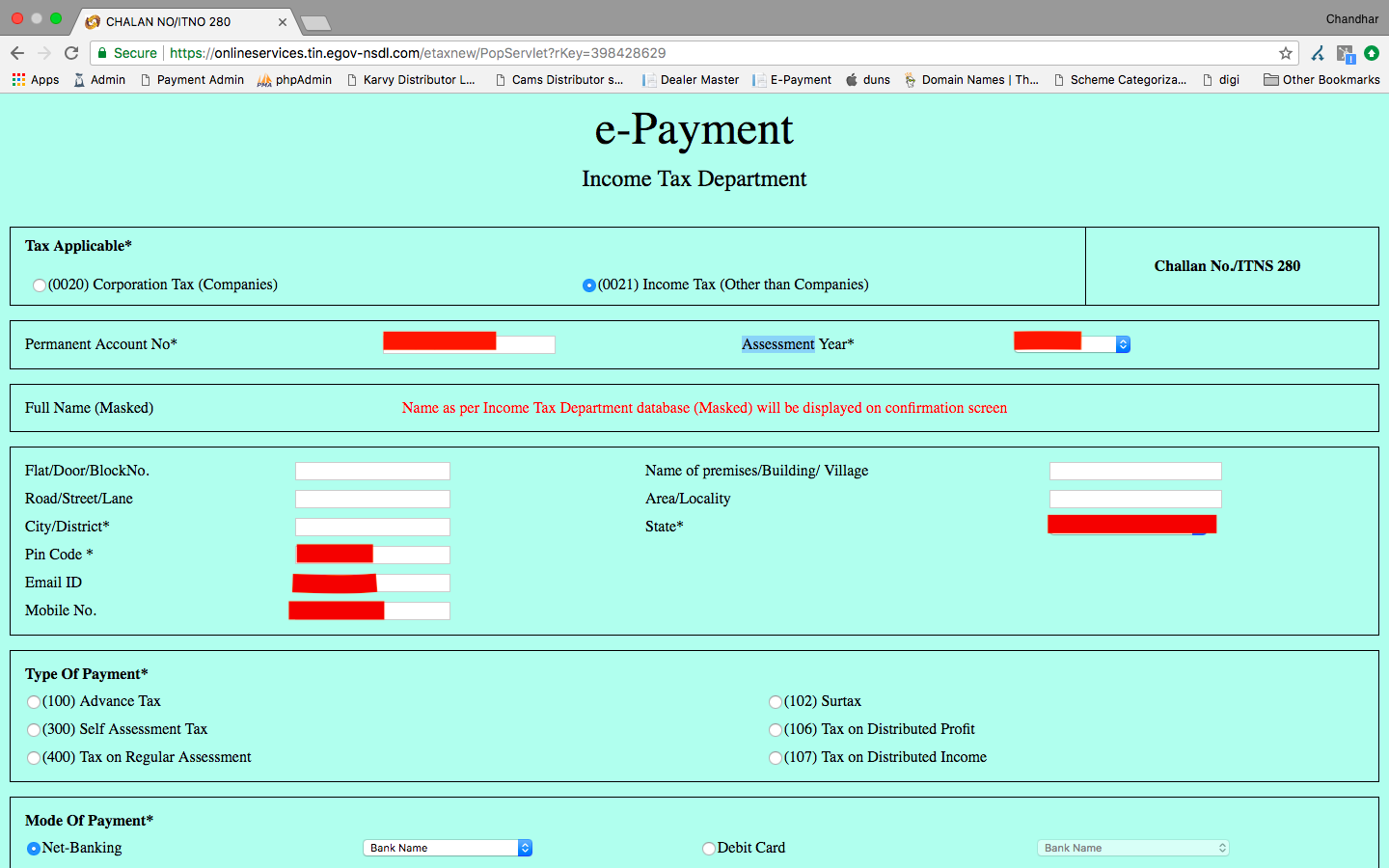

Step 1: Go to Tax Information Network website. And Select Challan 280

Step 2: Tax Applicable

- If you are Paying Income Tax for a Company then Select Tax Applicable as (0020) Corporation Tax (Companies).

- If you are Paying Income Tax as an Individual then Select Tax Applicable as (0021) Income Tax (Other than Companies).

- Enter your Permanent Account Number (PAN Number). Select the Assessment Year (Check Our Table for Assessment Year).

- Complete your Information on City, State, Pin Code, Email ID, Mobile No.

Step 3: Type of Payment

Select the Type of Tax Payment you are doing.

- (100) Advance Tax – If you are Paying Tax during the Financial Year as Advance tax.

- (300) Self Assessment Tax – If you are Paying Tax after the end of Financial year

- (400) Tax on Regular Assessment – If you are Paying Tax on a Demand Notice by Income Tax Department

Step 4 : Mode of Payment

You can Choose to make the Tax Payment Using Net Banking or Debit Card. Once you enter the Captcha Image and Click Proceed. You will be redirected to a Confirmation Page.

Please Check the Information entered is Correct and then Click Submit to Bank.

Step 5: Making Payment

You will be Redirected to the Bank Authentication Page. Enter the Amount Including any Penalty in Income Tax or Basic Tax. And make the Payment.

Once the Payment is Complete you will Get a the Challan 280. Please save the Copy of the Challan.

Incase you miss the challan it can be reprinted from your Net Banking Account.

File your Tax online using our Free Tax Filing Service here www.fundsinn.com/income-tax-efiling

YOU MAY ALSO LIKE

Everything That You Need to Know About Income from House Property Your home, your office, or even a shop can be your house property. According to the Income Tax Act, there is no differentiation between a commercial and a residential property. Every property is taxed under the single head of ‘income from house property.’ Here is all you need to…Read More

Income Tax Slabs are differentiated based on the Tax Status, Gender and Age of Individual Tax Payer Income Tax Slab Rates for an Individual Upto the Age of 59 Years for both Male and Female or an HUF (Hindu Undivided Family) in Financial Year (2019-2020) Assessment Year (2020-2021). Taxable Income Range Tax Rate in % 0- 2,50,000 NIL 2,50,001 –…Read More

Which is Better ELSS or PPF? Savings form an important part of our life. It is important that you not only save but also invest the savings into the right products. It is essential to have knowledge of different products when making an investment decision. Equity Linked Savings Scheme (ELSS) and Public Provident Fund (PPF) are two products, which are…Read More